One of the most common problems for start-up companies is cash flow management. Proper Cash flow management techniques can help both struggling, slow-growth companies, and successful, high growth companies. Cash for a business is like blood for a person, without adequate flow, both the business and person are unhealthy. By managing accounts receivables and payables, inventory, and product pricing, a company can improve its cash flow, grow, and thrive.

1. Controlling the Accounts Receivable And Accounts Payable

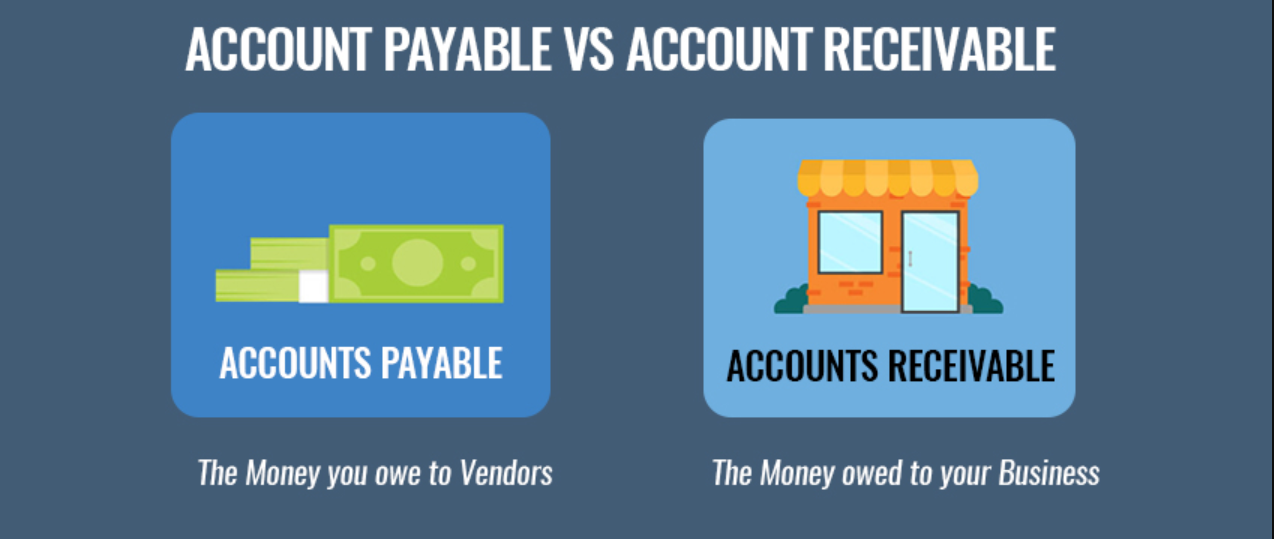

An important part of cash flow management is controlling the company’s accounts receivable and accounts payable. Business owners need to collect their accounts receivable as quickly as possible. A financial incentive to business customers, such as a 2% discount off an invoice for payments made within ten days, is an effective policy to encourage prompt payment.

All of this is a really important section of this particular issue. On the other side, with accounts payable, withhold all payments until the due date. Transfer the funds electronically to make payments on the last day they’re due. If available cash to pay the company’s bills is insufficient, call the companies and tell them that payments will be made late, but will be paid on a specific date, if possible.

2. Implementing a collection system

Implementing a collection system, with set actions like e-mails, postcards, and telephone calls to the right people to accelerate payments can reduce the number of days that accounts receivable is outstanding. Any disputes should be aggressively resolved. If some customers continually pay their bills 30+ days late, the business needs to have significant late fees to cover the extra expenses involved in collecting these payments.

By being assertive, the other company’s collection personnel will view the company as more responsible than companies that do not respond to their collection efforts.

3. Fix the Slow Inventory Turnover

Too much inventory and slow inventory turnover can also cause cash flow problems. Inventory management, keeping only the inventory needed, helps with cash flow. If some inventory is obsolete or damaged, quickly sell those goods at a discount. This will reduce inventory costs, such as lowering times for inventory audit, security costs, and warehouse energy costs. And the cash recovered increases available cash for operations. Another solution for excess inventory is to sell it at a discount to obtain new customers or to reward existing customers. Make sure they know that sales are a rare promotion. The business can gain new customers, please existing customers, and improve its cash position.

4. Using Ratios And Trends

Certain financial ratios are important to monitor receivables, payables, and inventory. The average collection period is the average number of days to collect accounts receivables (accounts receivable/average daily sales). Days payables outstanding is the average number of days to pay the accounts payable (accounts payable/average daily cost of sales). The number of days’ sales in inventory is the average number of days it takes to sell the inventory (inventory / average daily cost of goods sold). By using these ratios and following their trends, a company can react quickly to better manage their cash flow.

5. Appropriate Pricing Of the Product

Another common problem for entrepreneurs is pricing their products or services. Selling products for little or no profit will lead to cash flow problems. Proper pricing is difficult for start-up businesses, and many entrepreneurs underprice their products to gain new customers. Companies can’t survive long term with this strategy. Companies should raise their product prices until they’ve adequate profits, even if they lose some customers.

By managing accounts receivables, accounts payables, inventory, and product pricing, start-up companies can improve Cash Flow Management Techniques, increase profits, and grow.

Start using ZapInventory today

Start using ZapInventory today