All about invoicing under GST :

The GST or the Goods and Service Tax is a comprehensive indirect tax on manufacturing, sale, and purchase of goods and services throughout India thus replacing the taxes levied upon by the Central and State Governments. So the businesses registered under the GST Act can claim the tax credit to the extent of GST paid by them on the purchase of goods and services as part of their regular commercial activity. Exports under this Act is going to be considere as a zero-rated supply and imports will be levied on the same tax rates as domestic goods and services adhering to the destination’s principle besides the Customs Duty which won’t be absorbed in the GST Act.

Invoicing: A Brief Overview

An invoice also commonly known as sales invoice is a bill that is sent by the supplier of a product or a service to the consumer or purchaser. The invoice creates an obligation on the part of the customer to pay the seller the amount of the article or service sold, thus creating an account receivable.

An invoice can be define a written verification of the agreement between the vendor and the buyer of the goods or services. Invoices are a very integral part of a company as they help keep a systematic record of all the transactions of the enterprise.

An invoice usually includes the following:

- DATE: The date is usually the date on which the invoice was first created. This is useful when the customer has to make payments on a later date.

- NAME AND ADDRESS OF THE BUYER: The name and address of the client are important in cases where you need to send any official letter or documents. In an electronic invoice, the buyer’s email id is only necessary.

- DESCRIPTION OF ITEMS PURCHASED: Mentioning the amount of articles sold and their rates on tangible goods as well as services provided helps keep track of the inventory in your company and avoids misappropriation.

- TERMS OF PAYMENT: The terms of payment must also be define in the invoice if the payment is to be made at a future date.

Types of Invoices to be prepared under the current tax regime:

The current tax laws makes it compulsory for all traders to maintain two types of invoices:-

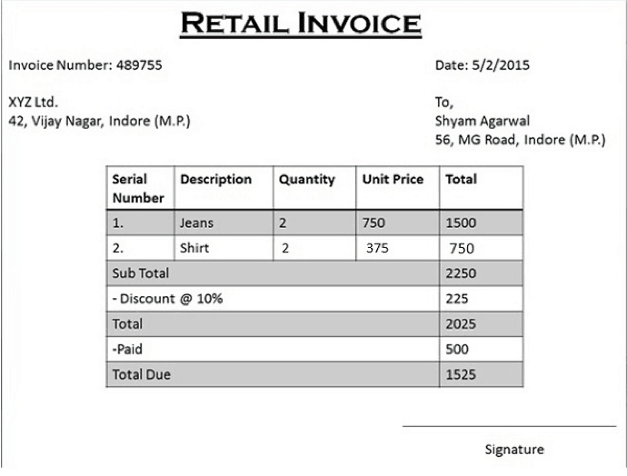

- RETAIL INVOICE: A Retail Invoice is a type of Invoice issued by registered dealers for any sale of goods or services where a Tax Invoice is not authorized to be issued. A Retail Invoice is however not necessary if the total sales value is less than rupees one hundred. A Retail Invoice is usually issue for interstate sales and domestic branch transfers and exports. A purchaser cannot claim input tax credit on a Retail Invoice.

A retail invoice typically consists of the following items:

- Invoice Number;

- Date of Issue;

- Buyer Details;

- Quantity;

- Unit Price;

- Total Amount;

- Discount (if provided);

- Signature of authorized personnel.

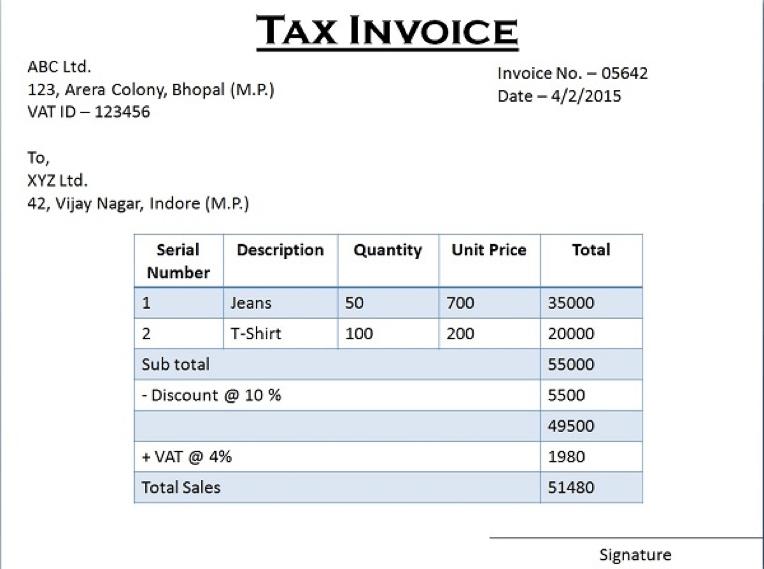

- TAX INVOICE: A Tax Invoice is issued by a registered dealer selling goods to another registered dealer. The Tax Invoices are submitted by the register dealers at the end of the financial year or fiscal year to the relevant tax authorities. Thus , helping the government in avoiding the chances of tax evasion.

The Tax Invoice usually contains the following items:

- Invoice Number;

- Date of issue of Invoice;

- Buyer Details;

- Tax Identification Number (TIN);

-

Quantity;

-

Unit Price;

-

Total Amount;

-

Tax charged;

-

Signature of authorized personnel.

Types of Invoices to be prepared under Goods and Services Tax, Act:

The GST Act requires two types of invoices namely: tax invoice and bill of supply that are need to be issued before or on the occurrence of an individual event within the prescribed time. Thus, an invoice is require for any form of supply such as sales, barter exchange, rental, license or disposal. The primary function of GST is to check the Input Tax Credit claims for which all the relevant data regarding the invoices are to be upload and reviewed. The Act requires all register dealers to file their data according to the invoices.

The GST Act requires the following invoices to be issue:

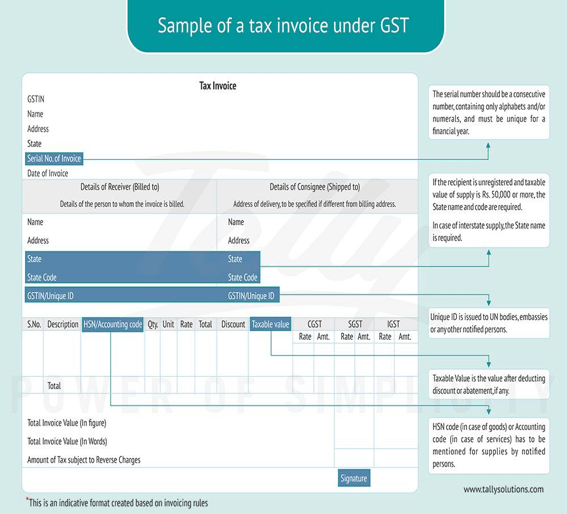

- TAX INVOICE: Any person registered to pay tax under the GST Act supplying Goods and Services is supposed to issue a Tax Invoice for all the supplies affected. The Tax Invoice must be issue before or at the time of sale of the goods and services or during the delivery of said goods and services to the recipient.

As per the new rules, the Tax invoice should contain the following details:

- The Tax invoice should primarily contain the Name, Address and registration number of the supplier.

- A consecutive serial number containing only alphabets or numbers or both, unique for every financial year. This is the invoice number.

- Date of issue of the invoice.

- The tax invoice should also contain the Name, Address and Registration Number of the registered buyer. If the consumer is not a registered dealer, the Name and Address is sufficient.

- For sale value exceeding fifty thousand rupees, the invoice should contain the Name and Address of the buyer along with the delivery address, the name of the state and its particular state code.

- The HSN or the Accounting Code of Services.

- Description of goods and services sold.

- The Quantity in case of goods along with its respective unit or Unique Quantity Code.

- The total value of the goods or services sold.

- The taxable value of good and services after adjusting for discount.

- The rate of tax charged.

- The amount of tax charged in respect of the taxable goods and services.

- Place of Supply with the name of the State in case of Inter-State sale.

- The place of delivery if the same is different from the place of supply.

- It should also be mentioned if the tax is payable on reverse charge.

Rules for preparing a tax invoice under GST

- The Tax Invoice is to be prepare and issue within 30 days from the date of sale of the good or service.

- In cases where the supplier is a Bank or any other such financial institution, the invoice should be prepare and issue within 45 days of the supply of the service.

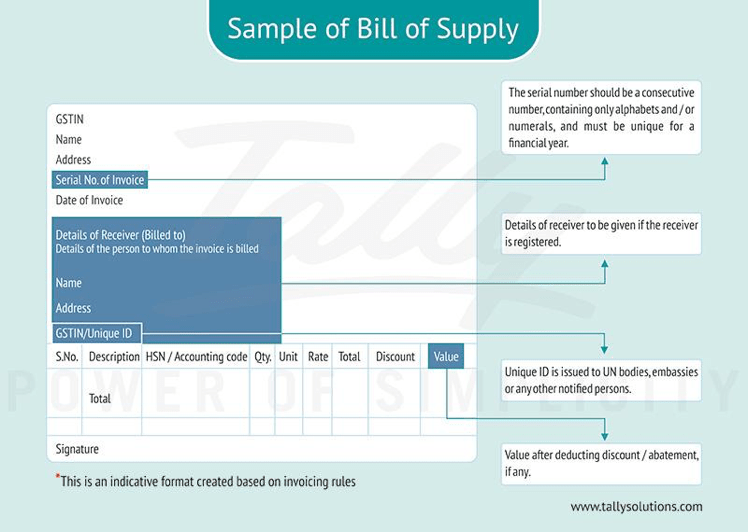

BILL OF SUPPLY:

- Any registered dealer selling exempted goods or services or a dealer who has opted for a composite levy scheme has to issue a Bill of Supply instead of the regular Tax Invoice under the GST Act , however a registered dealer cannot use the Bill of Supply to claim Input Tax Credit. A Bill of Supply is not compulsory in cases where the total bill amount is less than rupees 100 unless the buyer insists on an invoice. A consolidate Bill of Supply should be prepare at the end of the business day for all the supplies for which the bill of supply is not issue.

A Bill of Supply should contain the following details:

- The Name, Address and Goods and Services Tax Identification Number (GSTIN).

- A Bill of Supply number generated separately for each bill of supply having a unique number for every financial year.

- The date of Issue of the Bill of Supply.

- For a registered buyer, the name, address and GSTIN number should also be included.

- HSN code of goods or Accounting Code for Services.

- The description of the goods or services sold.

- The value of said goods or services after adjusting for discount.

- Signature of the seller.

CONCLUSION:

The GST Act is sure to bring much clarity to transactions between traders and between merchants and customers, Because the invoice formats as seen under the GST is also more detailed compared to the current invoices prepared under the current tax regime.The most significant benefit of the GST Act is that it will absorb over 17 indirect taxes into one consolidated tax. Invoicing under the GST Act is going to change the way trade is conduct in India.

Start using ZapInventory today

Start using ZapInventory today